Explore Our Coverage

For Canadian Residents

Baggage

Imagine arriving at your destination only to discover that your suitcase is missing. This coverage provides up to $1,500 per insured person, per trip, in event of delay, loss, theft, or damage to your luggage, helping you enjoy your trip despite these inconveniences.

Baggage coverage provides up to $1,500 per insured person in the following situations:

-

Stolen, lost or damaged baggage: Receive up to $1,500 to repair or replace items.

-

Delayed checked baggage: Get up to $500 for essential items (such as toiletries and clothing) and sports equipment rental.

-

Replacement of lost or stolen official documents: Receive up to $250 to replace your passport, driver’s licence, birth certificate, and/or visa.

Please note that a maximum refund per item or category of items applies. Check your insurance policy for full details.

Baggage coverage does not include losses or situations such as:

-

Loss or damage related to certain personal items (e.g., cash, glasses and contact lenses, medication, cosmetics, prostheses, and orthoses)

-

Breakage of fragile or breakable items

-

Act of war and civil unrest

-

Theft without signs of forced entry into a vehicle (please note that thefts with visible signs of burglary are covered)

-

Neglect, recklessness or disappearance (not classified as theft)

Other exclusions may apply. Please review your travel insurance policy for full details.

Explore our comprehensive travel insurance options.

For our most comprehensive insurance in case of an emergency or unforeseen event, you can combine all coverage options:

Emergency Medical Care, Trip Cancellation and Interruption, Accidental Death or Dismemberment, and Baggage.

Explore our comprehensive travel insurance options.

For our most comprehensive insurance in case of an emergency or unforeseen event, you can combine all coverage options:

Emergency Medical Care, Trip Cancellation and Interruption, Accidental Death or Dismemberment, and Baggage.

Frequently Asked Questions

Our Baggage coverage insures you for up up to $500 if your baggage is delayed for more than 12 hours during your trip.

Our Baggage coverage insures you up to $1,500 if your baggage is lost, stolen, or damaged during your trip. Note that this coverage includes limitations and exclusions as stated in our travel insurance policy.

Travel insurance must be purchased before you leave your province of residence and should cover the entire duration of your trip.

The coverage provided by your credit card company may have limitations or restrictions. It is important to review your policy thoroughly for coverage details. It is often recommended that you purchase additional coverage for complete protection.

Check your credit card coverage for the following:

Travel duration

Travel insurance cannot be purchased once you depart from Quebec. It is important to check the length of stay covered by your credit card company, as well as any restrictions based on age.

Emergency medical care coverage

There are often strict eligibility and stability requirements based on your current health. Make sure you understand the exclusions in your coverage prior to your departure. You could be quite unhappy to learn that a health condition is excluded right when you need emergency medical care. Also make sure the coverage amounts are enough, and inquire about any deductibles you may have to pay.

Trip cancellation and interruption

If you incurred fees up front, make sure the amount covered under trip interruption/cancellation is enough to save you from financial losses. Most credit card companies do not cover trip interruption or cancellation, and when they do, the maximums are not sufficient to fully cover your costs. Blue Cross can provide you with coverage that protects you in the case of unforeseen situations.

Protect yourself and your family. Don’t risk your financial security with incomplete coverage. With Blue Cross travel insurance, you enjoy complete medical coverage by a travel insurance company recognized around the world.

Yes, you can reach us toll-free or by calling collect during your trip using the following numbers:

- From Canada or the United States: 1-800-361-6068

- From anywhere else in the world (call collect): 514-286-8411

Read Our Blog Posts

Flight Delay Service: Enjoy Added Benefits at No Extra Cost with Québec Blue Cross Travel Insurance

Are you searching for the best travel insurance for your next adventure? Look no further than Québec Blue Cross...

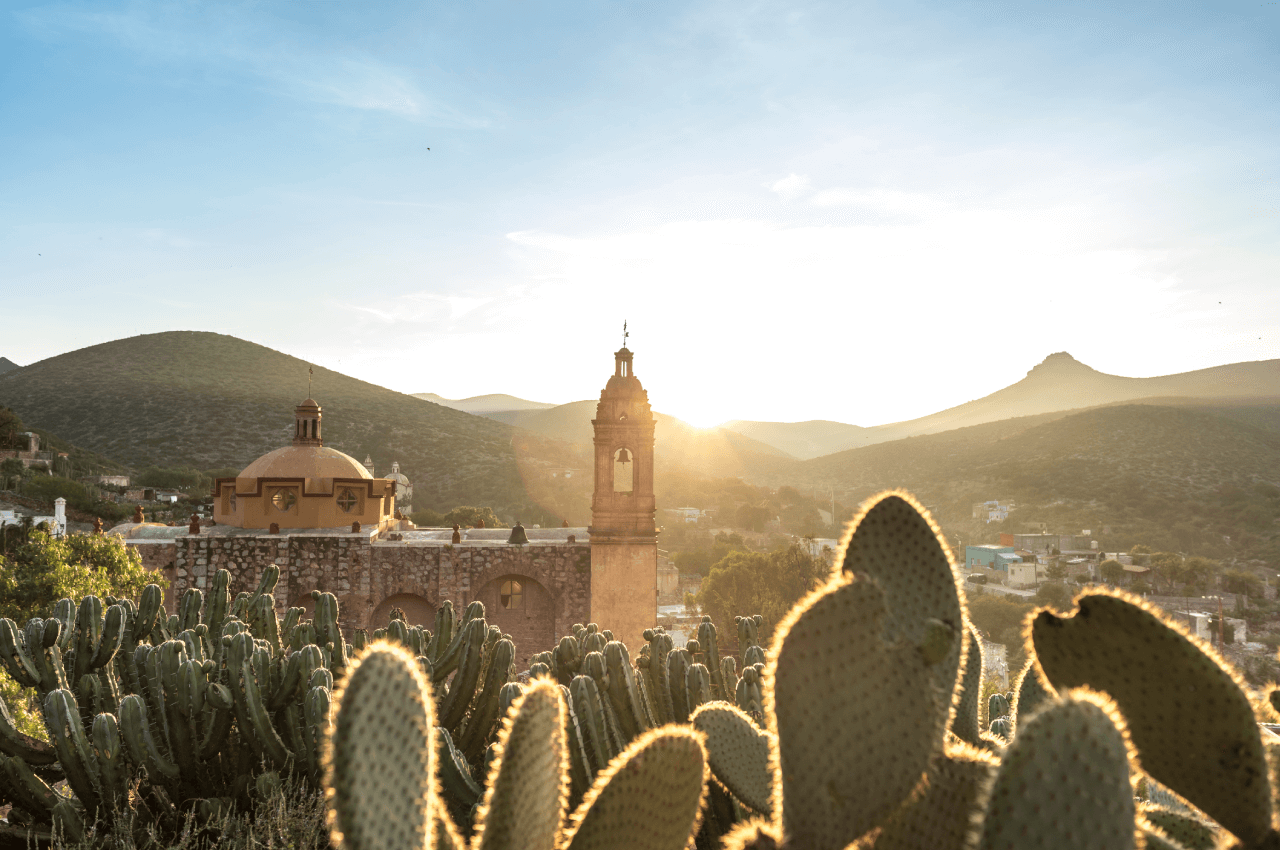

Travel with confidence with our coverage

At Québec Blue Cross, we understand that your time is valuable, especially when planning your well-deserved getaways...